Blanket Aerogel Market - Forecast (2022-2027)

The Blanket Aerogel Market size is estimated to reach US$1.1 billion by 2027 after growing at a CAGR of 15.2% during the forecast period 2022-2027. Aerogel granules are typically enclosed in non-woven fibers to create an aerogel blanket that is less dusty, compressible and very effective insulation material and it is derived from silica, polymer and carbon. The increased use of aerogel blankets in aerospace is projected to boost the growth of the aerogel blanket market. The strong demand from the oil and gas industry to minimize the production cost is also a crucial element that will favor the expansion of the aerogel blanket market. The covid-19 pandemic majorly impacted the blanket aerogel market due to restricted production, supply chain disruption, logistics restrictions and a fall in demand. However, with robust growth and flourishing applications across major industries such as transportation, building & construction and others, the blanket aerogel market size is anticipated to grow rapidly during the forecast period.

Blanket Aerogel Report Coverage

The “Blanket Aerogel Report – Forecast (2022-2027)” by IndustryARC, covers an in-depth analysis of the following segments in the blanket aerogel Industry.

By Type: Silica, Polymers and Carbon.

By Layer: Mono-Layer and Multi-Layer.

By End-use Industry: Transportation (Automotive, Aerospace, Marine and Locomotive), Building & Construction (Residential, Commercial and Infrastructure), Oil & Gas, Chemical &Pharmaceuticals, Electrical & Electronics, Medical & Healthcare and Others.

By Geography: North America (the USA, Canada and Mexico), Europe (UK, Germany, France, Italy, Netherlands, Spain, Belgium and Rest of Europe), Asia-Pacific (China, Japan, India, South Korea, Australia and New Zealand, Indonesia, Taiwan, Malaysia and Rest of APAC), South America (Brazil, Argentina, Colombia, Chile and Rest of South America), Rest of the World [Middle East (Saudi Arabia, UAE, Israel and Rest of the Middle East) and Africa (South Africa, Nigeria and Rest of Africa)].

Key Takeaways

Asia-Pacific dominates the blanket aerogel market size, owing to growing demand from end-use industries such as automobiles, building & construction and others, thereby boosting the demand for blanket aerogel in APAC during the forecast period.

The significant increase in demand for these blankets due to their non-toxic and environmentally friendly nature is projected to drive blanket aerogel market expansion.

Rapid improvements in the field of apparel manufacturing, as well as the stability of aerogel blankets due to their moisture resistance, are projected to provide a number of potential prospects for the aerogel blanket market.

However, However, the nonwoven market's growth may be hampered by frequent price fluctuations in raw materials which hamper the market growth of blanket aerogel.

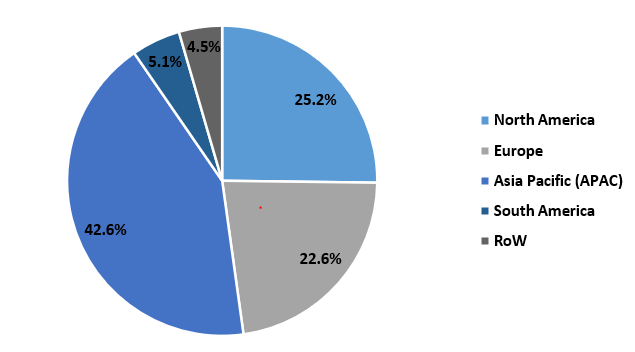

Figure: Blanket Aerogel Market Revenue Share, 2021 (%)

For More Details On this report - Request For Sample

Blanket Aerogel Market Segment Analysis – by Type

Silica held the largest share in the Blanket Aerogel Market share in 2021 and is forecasted to grow at a CAGR of 15.1% during the forecast period 2022-2027, owing to the extensive characteristics provided by silica when compared to other material types such as polymer and carbon. Aerogel blankets made of silica are created utilizing fiber reinforcements, which turn inelastic aerogels into robust, stretchable and water-repellent textiles. It is anticipated that these nonflammable blankets comprised of silica aerogels will be particularly successful in passive fire protection in homes, companies and other infrastructure, which drives the market growth of silica in the blanket aerogel market. Thus, these extensive properties compiled with increasing application in the aerospace and building & construction industry are majorly driving its segmental growth. Thus, the high demand for silica from various industries will propel the blanket aerogel industry.

Blanket Aerogel Market Segment Analysis – by End-use Industry

Building & Construction held the largest share in the Blanket Aerogel Market share in 2021 and is forecasted to grow at a CAGR of 15.4% during the forecast period 2022-2027. Blanket aerogel is flexible blanket insulation that can assist reduce energy loss while also saving space in commercial and residential buildings. Blanket aerogel is an excellent energy-saving material that prevents heat loss or gains via the building envelope. It is often utilized for total coverage in walls, floors and roofs, as well as framing and windows, to provide maximum energy efficiency. The building and construction sector is flourishing due to increasing investment and urbanization, the development of architectural sites and residential housing plans. For instance, according to the U.S Census Bureau, the seasonally adjusted annual rate of construction in the United States increased from US$1,553,547 in April 2021 to US$1,744,801 in April 2022. According to Oxford Economics, the global construction output in 2020 was US$10.7 trillion 2020 and is expected to grow by 42% or US$4.5 trillion between 2020 and 2030 to reach US$15.2 trillion. With the rise in building and construction projects across the globe, the demand for blanket aerogel is anticipated to rise for various applications, which is projected to boost the market growth in the building and construction industry during the forecast period.

Blanket Aerogel Market Segment Analysis – by Geography

The Asia-Pacific held a significant share in the Blanket Aerogel Market share in 2021 up to 42.6%. The fueling demand and growth of blanket aerogel in this region are influenced by flourishing demand from major industries such as construction, automotive and others, along with fueling manufacturing activities across APAC. The building and construction sector is growing rapidly in Asia-Pacific owing to a major development in infrastructural projects, emphasis on affordable housing units and modular building technology. According to Japan's Ministry of Land, Infrastructure, Transport and Tourism, the construction order for new houses rose to 32.3% in June 2021, compared to -13.4% in June 2020. Furthermore, the Make in India campaign by the Government of India plans to achieve infrastructural investment worth US$965.5 million by the year 2040. According to the International Trade Administration, the construction sector in China is projected to grow at an average of 8.6% from the year 2022 to 2030. With the robust growth of the building and construction industry in Asia-Pacific, the demand for blanket aerogel in construction will rise, which is projected to boost the market growth in the building and construction industry during the forecast period.

Blanket Aerogel Market Drivers

Rising Demand for Oil and Gas Industry:

The rising demand for blanket aerogel in the oil & gas industry is the major factor driving the market growth of the blanket aerogel market. Aerogel blankets are primarily used to improve the insulation of deep-sea pipes and oil and gas pipelines in order to minimize production costs, increase pipeline compression resistance and reduce the quantity of steel used in construction. The industrial, commercial and residential sectors' consistently rising need for oil and gas supplies is a major factor in the blanket aerogel market's expansion. For instance, Nigeria completed the Dangote Refinery and Polypropylene Plant project at the end of 2021. The plant is anticipated to process various crude grades, including shale oil and have a production capacity of 12 300 b/d of fuel oil, 104,000 b/d of diesel and 153,000 b/d of gasoline, 4,109 b/d of LPG and 73,000 b/d of jet fuel. As a result, the need for blanket aerogel to comply with current environmental requirements will rise along with the demand for oil and gas production activities in several nations throughout the world, fueling blanket aerogel industry expansion in the coming years.

Bolstering Growth of the Automotive Industry:

The bolstering growth of the automotive industry is driving the market growth of blanket aerogel. Aerogel blankets have high mechanical resistance, providing durable and long-lasting insulation and low thermal conductivity, allowing for a reduction in total insulation thickness. These features improve blanket capabilities and expand the aerogel blanket market in the automobile industry. Moreover, the automotive sector is rapidly growing due to factors such as the high demand for passenger vehicles among the middle class, urbanization and flourishing growth in fuel-efficient vehicle technologies. According to the report from India Energy Storage Alliance, the EV market in India is expected to increase at a CAGR of 36% until 2026. Furthermore, the National Automobile Dealers Association (NADA) anticipates that the new light-vehicle sales in 2022 will show an increase of 3.4% compared to 2020. According to the International Organization of Motor Vehicle Manufacturers (OICA), the global production of passenger cars rose from 55834456 units in 2020 to 57054295 units in 2021. With the increase in automotive vehicle production and growth prospects, the demand for blanket aerogel will rise. Thus, with flourishing demand in automotive, the blanket aerogel is driving and growing rapidly.

Blanket Aerogel Market Challenge

High Manufacturing Cost:

The high cost of production is one of the primary issues limiting the growth of the aerogel market. The high cost of silica aerogels is attributable to the high cost of raw materials labor-intensive approach techniques and enterprises' configuration of relatively small production capacity. Aerogel materials necessitate extensive research and development, making the entire process costly. Aerogel materials are created utilizing less versatile synthetic processes. Due to the extremely specialized production procedures, aerogel manufacture demands a complex facility. Supercritical drying is the most expensive step in the aerogel manufacturing process. As a result of this serious flaw in the new manufacturing technology, overall production costs rise, requiring manufacturers to boost product prices to meet the costs, which has a negative impact on blanket aerogel market growth.

Blanket Aerogel Market Industry Outlook

Technology launches, acquisitions and R&D activities are key strategies adopted by players in the blanket aerogel market. The top 10 companies in the Blanket Aerogel market are:

Cabot Corporation

Aerogel Technologies LLC

Enersens Aerogel

Green Earth Aerogel Technologies

Armacell International S.A.

ZhengZhou Joda Technology Co. Ltd.

Aspen Aerogels Inc.

Acoustiblok UK Ltd.

Active Aerogels

Airglass AB

Recent Development

In August 2020, Armacell, introduced ArmaGel DT, a next-generation flexible aerogel blanket for dual-temperature and cryogenic applications. ArmaGel® DT aerogel insulation blanket with an integrated vapor barrier is available in thicknesses of 5, 10, 15 and 20 mm.

Relevant Reports

Aerogel Market - - Industry Analysis, Market Size, Share, Trends, Application Analysis, Growth and Forecast Analysis

Report Code: CMR 0271

Ceramic Fibers Market- - Industry Analysis, Market Size, Share, Trends, Application Analysis, Growth and Forecast Analysis

Report Code: CMR 0284

Non-Woven Adhesive Market - - Industry Analysis, Market Size, Share, Trends, Application Analysis, Growth and Forecast Analysis

Report Code: CMR 0297

For more Chemicals and Materials Market reports, please click here

Blanket Aerogel Report Coverage

The “Blanket Aerogel Report – Forecast (2022-2027)” by IndustryARC, covers an in-depth analysis of the following segments in the blanket aerogel Industry.

By Type: Silica, Polymers and Carbon.

By Layer: Mono-Layer and Multi-Layer.

By End-use Industry: Transportation (Automotive, Aerospace, Marine and Locomotive), Building & Construction (Residential, Commercial and Infrastructure), Oil & Gas, Chemical &Pharmaceuticals, Electrical & Electronics, Medical & Healthcare and Others.

By Geography: North America (the USA, Canada and Mexico), Europe (UK, Germany, France, Italy, Netherlands, Spain, Belgium and Rest of Europe), Asia-Pacific (China, Japan, India, South Korea, Australia and New Zealand, Indonesia, Taiwan, Malaysia and Rest of APAC), South America (Brazil, Argentina, Colombia, Chile and Rest of South America), Rest of the World [Middle East (Saudi Arabia, UAE, Israel and Rest of the Middle East) and Africa (South Africa, Nigeria and Rest of Africa)].

Key Takeaways

Asia-Pacific dominates the blanket aerogel market size, owing to growing demand from end-use industries such as automobiles, building & construction and others, thereby boosting the demand for blanket aerogel in APAC during the forecast period.

The significant increase in demand for these blankets due to their non-toxic and environmentally friendly nature is projected to drive blanket aerogel market expansion.

Rapid improvements in the field of apparel manufacturing, as well as the stability of aerogel blankets due to their moisture resistance, are projected to provide a number of potential prospects for the aerogel blanket market.

However, However, the nonwoven market's growth may be hampered by frequent price fluctuations in raw materials which hamper the market growth of blanket aerogel.

Figure: Blanket Aerogel Market Revenue Share, 2021 (%)

For More Details On this report - Request For Sample

Blanket Aerogel Market Segment Analysis – by Type

Silica held the largest share in the Blanket Aerogel Market share in 2021 and is forecasted to grow at a CAGR of 15.1% during the forecast period 2022-2027, owing to the extensive characteristics provided by silica when compared to other material types such as polymer and carbon. Aerogel blankets made of silica are created utilizing fiber reinforcements, which turn inelastic aerogels into robust, stretchable and water-repellent textiles. It is anticipated that these nonflammable blankets comprised of silica aerogels will be particularly successful in passive fire protection in homes, companies and other infrastructure, which drives the market growth of silica in the blanket aerogel market. Thus, these extensive properties compiled with increasing application in the aerospace and building & construction industry are majorly driving its segmental growth. Thus, the high demand for silica from various industries will propel the blanket aerogel industry.

Blanket Aerogel Market Segment Analysis – by End-use Industry

Building & Construction held the largest share in the Blanket Aerogel Market share in 2021 and is forecasted to grow at a CAGR of 15.4% during the forecast period 2022-2027. Blanket aerogel is flexible blanket insulation that can assist reduce energy loss while also saving space in commercial and residential buildings. Blanket aerogel is an excellent energy-saving material that prevents heat loss or gains via the building envelope. It is often utilized for total coverage in walls, floors and roofs, as well as framing and windows, to provide maximum energy efficiency. The building and construction sector is flourishing due to increasing investment and urbanization, the development of architectural sites and residential housing plans. For instance, according to the U.S Census Bureau, the seasonally adjusted annual rate of construction in the United States increased from US$1,553,547 in April 2021 to US$1,744,801 in April 2022. According to Oxford Economics, the global construction output in 2020 was US$10.7 trillion 2020 and is expected to grow by 42% or US$4.5 trillion between 2020 and 2030 to reach US$15.2 trillion. With the rise in building and construction projects across the globe, the demand for blanket aerogel is anticipated to rise for various applications, which is projected to boost the market growth in the building and construction industry during the forecast period.

Blanket Aerogel Market Segment Analysis – by Geography

The Asia-Pacific held a significant share in the Blanket Aerogel Market share in 2021 up to 42.6%. The fueling demand and growth of blanket aerogel in this region are influenced by flourishing demand from major industries such as construction, automotive and others, along with fueling manufacturing activities across APAC. The building and construction sector is growing rapidly in Asia-Pacific owing to a major development in infrastructural projects, emphasis on affordable housing units and modular building technology. According to Japan's Ministry of Land, Infrastructure, Transport and Tourism, the construction order for new houses rose to 32.3% in June 2021, compared to -13.4% in June 2020. Furthermore, the Make in India campaign by the Government of India plans to achieve infrastructural investment worth US$965.5 million by the year 2040. According to the International Trade Administration, the construction sector in China is projected to grow at an average of 8.6% from the year 2022 to 2030. With the robust growth of the building and construction industry in Asia-Pacific, the demand for blanket aerogel in construction will rise, which is projected to boost the market growth in the building and construction industry during the forecast period.

Blanket Aerogel Market Drivers

Rising Demand for Oil and Gas Industry:

The rising demand for blanket aerogel in the oil & gas industry is the major factor driving the market growth of the blanket aerogel market. Aerogel blankets are primarily used to improve the insulation of deep-sea pipes and oil and gas pipelines in order to minimize production costs, increase pipeline compression resistance and reduce the quantity of steel used in construction. The industrial, commercial and residential sectors' consistently rising need for oil and gas supplies is a major factor in the blanket aerogel market's expansion. For instance, Nigeria completed the Dangote Refinery and Polypropylene Plant project at the end of 2021. The plant is anticipated to process various crude grades, including shale oil and have a production capacity of 12 300 b/d of fuel oil, 104,000 b/d of diesel and 153,000 b/d of gasoline, 4,109 b/d of LPG and 73,000 b/d of jet fuel. As a result, the need for blanket aerogel to comply with current environmental requirements will rise along with the demand for oil and gas production activities in several nations throughout the world, fueling blanket aerogel industry expansion in the coming years.

Bolstering Growth of the Automotive Industry:

The bolstering growth of the automotive industry is driving the market growth of blanket aerogel. Aerogel blankets have high mechanical resistance, providing durable and long-lasting insulation and low thermal conductivity, allowing for a reduction in total insulation thickness. These features improve blanket capabilities and expand the aerogel blanket market in the automobile industry. Moreover, the automotive sector is rapidly growing due to factors such as the high demand for passenger vehicles among the middle class, urbanization and flourishing growth in fuel-efficient vehicle technologies. According to the report from India Energy Storage Alliance, the EV market in India is expected to increase at a CAGR of 36% until 2026. Furthermore, the National Automobile Dealers Association (NADA) anticipates that the new light-vehicle sales in 2022 will show an increase of 3.4% compared to 2020. According to the International Organization of Motor Vehicle Manufacturers (OICA), the global production of passenger cars rose from 55834456 units in 2020 to 57054295 units in 2021. With the increase in automotive vehicle production and growth prospects, the demand for blanket aerogel will rise. Thus, with flourishing demand in automotive, the blanket aerogel is driving and growing rapidly.

Blanket Aerogel Market Challenge

High Manufacturing Cost:

The high cost of production is one of the primary issues limiting the growth of the aerogel market. The high cost of silica aerogels is attributable to the high cost of raw materials labor-intensive approach techniques and enterprises' configuration of relatively small production capacity. Aerogel materials necessitate extensive research and development, making the entire process costly. Aerogel materials are created utilizing less versatile synthetic processes. Due to the extremely specialized production procedures, aerogel manufacture demands a complex facility. Supercritical drying is the most expensive step in the aerogel manufacturing process. As a result of this serious flaw in the new manufacturing technology, overall production costs rise, requiring manufacturers to boost product prices to meet the costs, which has a negative impact on blanket aerogel market growth.

Blanket Aerogel Market Industry Outlook

Technology launches, acquisitions and R&D activities are key strategies adopted by players in the blanket aerogel market. The top 10 companies in the Blanket Aerogel market are:

Cabot Corporation

Aerogel Technologies LLC

Enersens Aerogel

Green Earth Aerogel Technologies

Armacell International S.A.

ZhengZhou Joda Technology Co. Ltd.

Aspen Aerogels Inc.

Acoustiblok UK Ltd.

Active Aerogels

Airglass AB

Recent Development

In August 2020, Armacell, introduced ArmaGel DT, a next-generation flexible aerogel blanket for dual-temperature and cryogenic applications. ArmaGel® DT aerogel insulation blanket with an integrated vapor barrier is available in thicknesses of 5, 10, 15 and 20 mm.

Relevant Reports

Aerogel Market - - Industry Analysis, Market Size, Share, Trends, Application Analysis, Growth and Forecast Analysis

Report Code: CMR 0271

Ceramic Fibers Market- - Industry Analysis, Market Size, Share, Trends, Application Analysis, Growth and Forecast Analysis

Report Code: CMR 0284

Non-Woven Adhesive Market - - Industry Analysis, Market Size, Share, Trends, Application Analysis, Growth and Forecast Analysis

Report Code: CMR 0297

For more Chemicals and Materials Market reports, please click here

Comments

Post a Comment